I must apologies before I give you these basic tax and spending briefings from the IFS – the feed I am watching is temperamental and cut out half way through the Conservatives section on specific tax cuts, which I will update later.

Conservatives

The Conservatives have outlined a package of tax changes that they argue would be broadly revenue neutral.

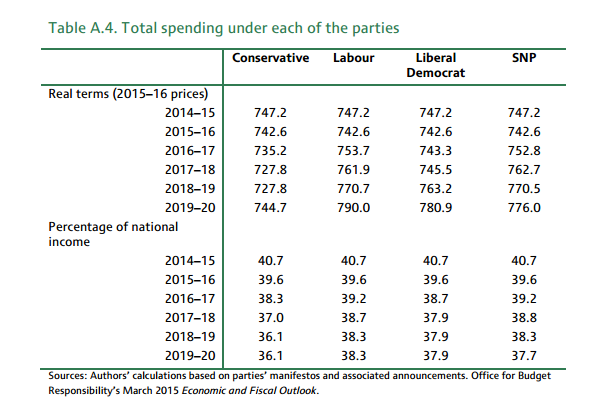

Under Conservative plans we would see an increase in the tax burden driven by the policies set in place by the coalition and the underlying fiscal drag, the IFS say. For example an already promised increase in national insurance contributions will push up taxes. This is balanced by a restriction on tax relief on pension contributions for the richest pensioners and anti-avoidance measures.

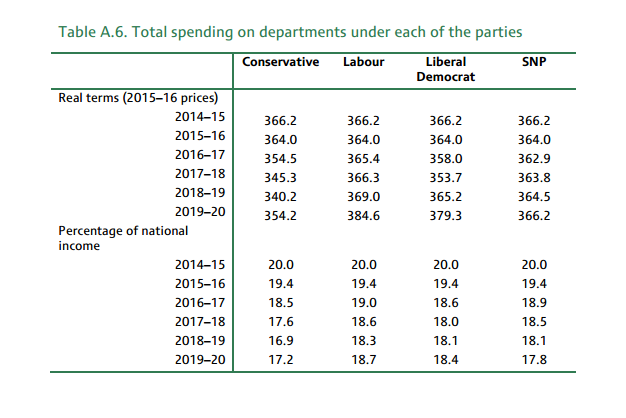

The Conservatives would continue cutting spending to 18/19, the IFS say. It would be the lowest to 1999/2000 under the Tories if this happens.

Labour

Labour have laid out tax rises of 6 billion – things like mansion tax and changes to pensions tax relief. They want to raise 7.5 billion from largely unspecified tax avoidance measures. The IFS estimate that overall tax burden is slightly higher than the Conservatives, a net tax rise of 0.7% of GDP by 2019-20.

Labour would cut spending but cut it less quickly than the Conservatives they say and would leave public spending at the lowest since 2002/2003.

Lib Dems

The Lib Dems say that the promises in their manifesto add up to a net tax rise of about 3 billion – they want to raise even more from tax avoidance, and they want £10 billion from this by end of the parliament. So overall its a tax rise about the same as Labour, , a net tax rise of 0.6% of GDP by 2019-20.

Lib Dems somewhere in between Labour and Conservatives when it comes to public spending. We would see public spending falling to 2001/2002 levels, the IFS say.

SNP

The party have a revenue neutral approach, according to the IFS. The cuts are very similar to Labour but they are all to fund tax cuts. They say it is commendable that unlike other parties while the SNP want more money from tax-avoidance clamp downs they have not predicated their plans on this. The overall tax burden, they say will also be slightly higher than the Conservatives but this is mainly because they are not banking on the tax avoidance revenue in their budget.

On public spending the IFS say that the SNP want to increase public spending by 0.5% in real terms – which the IFS say is not actually a “very big increase”. in fact they say that their path of public spending looks the same as Labour to the end of 18/19.

Interesting SNP plans, according to the IFS, would leave public spending at a lower level than Labour and back at 2001/2 levels.

He says he’ll leave it to voters to decide whether the rhetoric of the party is the most important or the numbers the IFS crunched.